Tracy, CA is a city located in San Joaquin County, California. As of 2020, the city population was 93,000. In Tracy, CA, property taxes are assessed by the San Joaquin County Assessor’s Office.

A property’s assessed value is based on its fair market value, as determined by the county assessor. The assessed value is then multiplied by the applicable mill levy to determine the property taxes owed.

Do you have your eye on a property in Tracy, CA? If so, you’ll want to be aware of the property taxes in that area.

Whether you’re a first-time homebuyer or are simply curious about property taxes in Tracy, CA, we’ve got you covered! Keep reading for information on what goes into calculating these taxes and some examples of what you might expect to pay.

An Overview of Property Taxes in Tracy, CA

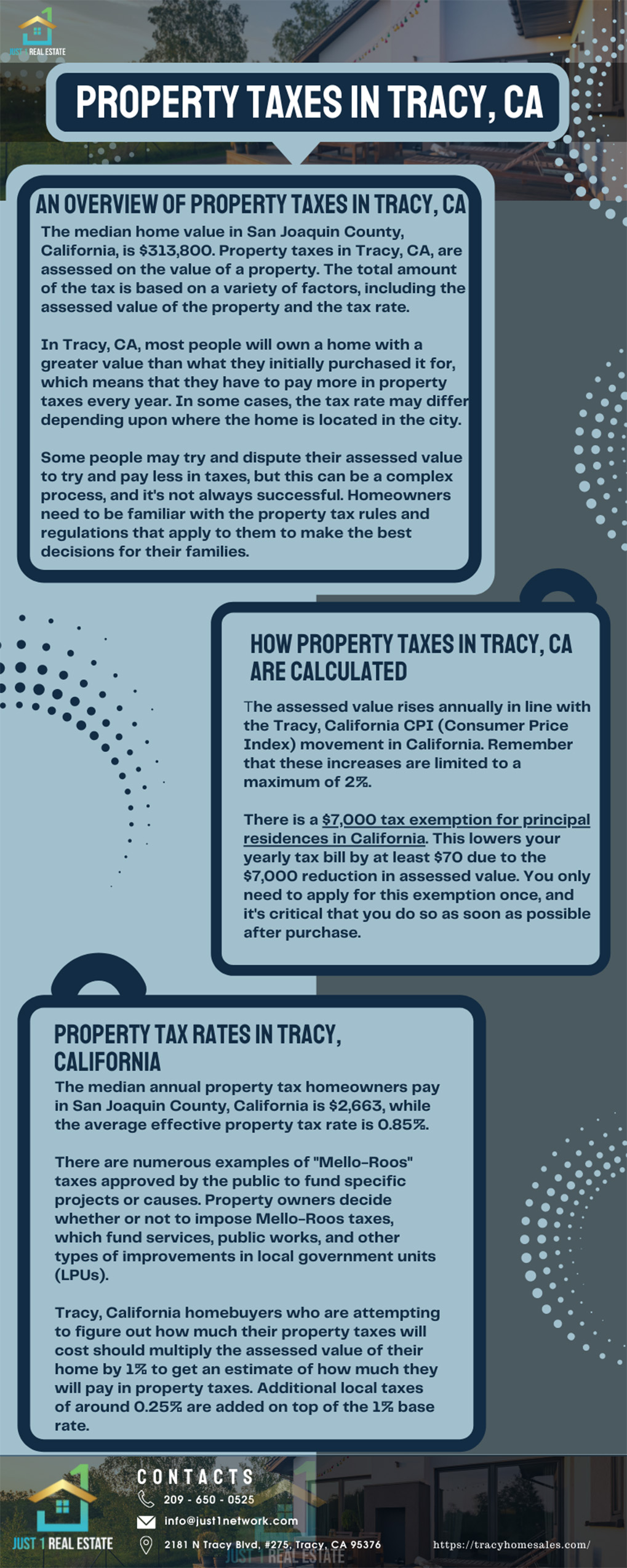

The median home value in San Joaquin County, California, is $313,800. Property taxes in Tracy, CA, are assessed on the value of a property. The total amount of the tax is based on a variety of factors, including the assessed value of the property and the tax rate.

For this assessment to change, either the homeowner must do some major renovations that increase the assessed value of their home or sell it at a higher price than what was originally determined by the assessor.

However, not many people can afford these upgrades, which means that most houses assessments will stay consistent with their initial evaluation, even if the properties have increased in worth since then.

In Tracy, CA, most people will own a home with a greater value than what they initially purchased it for, which means that they have to pay more in property taxes every year. In some cases, the tax rate may differ depending upon where the home is located in the city.

Some people may try and dispute their assessed value to try and pay less in taxes, but this can be a complex process, and it’s not always successful. Homeowners need to be familiar with the property tax rules and regulations that apply to them to make the best decisions for their families.

How Property Taxes in Tracy, CA are Calculated

Property Tax Rates in Tracy, California

A home’s assessed value is equivalent to its actual purchase price. Because of this, the value of the property in California is used to calculate the state’s property tax rate.

From there, the assessed value rises annually in line with the Tracy, California CPI (Consumer Price Index) movement in California. Remember that these increases are limited to a maximum of 2%.

As a result, the assessed value of a home occupied for a long time is frequently lower than the market value.

There is a $7,000 tax exemption for principal residences in California. This lowers your yearly tax bill by at least $70 due to the $7,000 reduction in assessed value. You only need to apply for this exemption once, and it’s critical that you do so as soon as possible after purchase.

Property Tax Rates in Tracy, California

The median annual property tax homeowners pay in San Joaquin County, California is $2,663, while the average effective property tax rate is 0.85%.

There are numerous examples of “Mello-Roos” taxes approved by the public to fund specific projects or causes. Property owners decide whether or not to impose Mello-Roos taxes, which fund services, public works, and other types of improvements in local government units (LPUs).

Tracy, California homebuyers who are attempting to figure out how much their property taxes will cost should multiply the assessed value of their home by 1% to get an estimate of how much they will pay in property taxes. Additional local taxes of around 0.25% are added on top of the 1% base rate.

Final Thoughts

Property taxes are an important part of homeownership in California. It’s critical that homeowners understand how their assessed value is calculated and what exemptions may be available to them.

It’s also important to be aware of the various local taxes that can be applied to a property. By understanding all of these factors, homeowners can make informed decisions about their purchases and pay the right amount of taxes.

We hope this article has helped provide an overview of property tax calculation in Tracy, CA. If you have any further questions or would like assistance with acquiring a property in this area, please don’t hesitate to contact us.

FAQs

What is a Property Tax Levy?

A levy is a charge or request for payment that’s made by a government unit, such as a city or school district. Levies are usually used to fund specific projects or services.

Who gets Property Tax Money?

The county treasurer gets the money and then distributes it to municipalities, schools, and special districts. Tax revenues are used to build and maintain roads and pay the salaries of municipal personnel, including police officers, firefighters, and members of the city’s department of public works.

How often do you Pay Property Tax in Tracy, California?

There are two equal installments of property taxes. There is a November 1st due date for the first instalment, covering July 1st through December 31st, and a default date of December 10th. The second instalment, which covers the months of January 1st to June 30th, is due on March 1st and will become due and payable on April 10th.

Do I Need to Reapply for the $7,000 Exemption Each Year?

No, the $7,000 exemption is automatically applied as long as you apply for it within 18 months of purchasing your home.

If I move, Do I Need to Notify Anyone?

Yes, you should notify the county assessor’s office of your change in address.

How do I get a copy of my Property Tax Bill?

You can get a copy of your property tax bill from the county assessor’s office.

How often do you Pay Taxes on the House?

Paying taxes is typically done in one of two ways:

Whenever the tax authority sends you a bill, you should send a check or make an online payment.

Deposit into an escrow account each month when you pay your mortgage.